An accountant is needed in any business, be it a large corporation or an individual entrepreneur. The responsibilities of the person holding this position are quite diverse and directly depend on the scope of the enterprise and the number of staff. Let us dwell on the specifics of the accountant and the area of responsibility in different areas.

Post Features

An accountant is a specialist who is responsible for accounting, he is involved in document management, sending tax and statistical reports to the appropriate authorities. Like any other profession, work as an accountant has its own advantages and disadvantages.

The advantages include certain points.

- The accountant was and remains a sought after specialty. Highly skilled workers are required in all sectors and are needed by every organization.

- Stable income. Moreover, it directly depends on the experience and professional category of the employee. The chief accountant of a reputable company can earn quite impressive amounts. The average salary of accountants is above the average for Russia.

- Office work, requires a permanent presence at the workplace, with the exception of rare visits to banks and regulatory agencies.

- For experienced professionals open up very good career prospects.

- Accountant if necessary can always work remotely on freelance, taking the bookkeeping of several small firms.

However, the disadvantages are quite significant:

- a very wide range of responsibilities;

- frequent processing, especially during the quarterly and annual reporting period;

- the presence of stressful situations;

- a high level of personal responsibility to the management of the company and regulatory bodies for mistakes made in the preparation of financial statements, and responsibility is not only administrative, but also criminal;

- the accountant cannot go on vacation at any time convenient for him, in particular, no one will let him go during the preparation and submission of reports;

- the work is complex, monotonous, associated with numbers and constant paperwork;

- any accountant must tirelessly increase his competence.

Responsibilities of an accountant in different areas

In small companies, one accountant maintains the entire accounting of the company, but in large enterprises there is a whole department in which specialists divide the area of professional responsibility among themselves.

Accountant-economist

The tasks of the accountant-economist include:

- assistance to the program for the implementation of the economic strategy of the enterprise;

- development and introduction of their own innovative ideas and methods for their implementation in practice with the aim of improving FED.

In the framework of the tasks, the accountant-economist is engaged in the following activities:

- the introduction of the financial and economic component of the enterprise FED analysis system;

- the development of long-term and short-term measures aimed at improving the position of the company in the market of services, as well as optimizing the financial performance of the company;

- participation in the creation of a set of measures, the main task of which is to improve the performance of the company as a whole;

- ensuring the correctness of the introduction of data on the activities of the company in automated accounting systems;

- provision of internal and external documentation at the first request of authorized persons.

Leading

The chief accountant of the company is assigned the functions of assistant chief accountant:

- performance of basic work on accounting of fixed assets, as well as commodity and monetary values, sales of products, results of the FED, mutual settlements with counterparties;

- participation in the organization of events aimed at a more efficient use of company resources and improving financial discipline;

- acceptance of primary documents for individual accounting areas, control over them and preparation for processing;

- reflection of all necessary financial transactions in the relevant accounts;

- identification of the reasons for the formation of losses, as well as non-production costs, making proposals for minimizing and preventing them;

- the implementation of the accrual of necessary taxes and fees, as well as contributions to extrabudgetary funds;

- providing company executives, as well as investors, auditors and lenders with correct data on the relevant accounting areas;

- participation in the AHD of the company in order to identify the reserves of the company;

- coordination of the work of a group of performers in the accounting department of the company.

According to the materials

The accountant of the material table should deal with:

- calculation of the cost of manufactured goods / services;

- acceptance and processing of primary financial documentation;

- reflection of all operations with fixed assets and materials in the relevant accounts of the accounting unit;

- calculation of the actual cost of work and goods;

- drawing up the necessary acts of reconciliation with counterparties;

- preparation of all necessary reports;

- supervision of accounts payable issues;

- inventory of company-owned materials;

- storage and documentation.

The main

This is a specialist whose activities cover all areas of accounting. His responsibilities include:

- assessment of primary documentation for compliance with legal requirements;

- analysis of accounting accounts for accounting for mutual settlements with counterparties of the enterprise;

- reconciliation of data with IFTS;

- monitoring the status of receivables;

- payroll;

- submission of reports to tax authorities;

- monitoring compliance with the financial side of the contracts;

- control over the correct reflection on the accounts of all ongoing financial and economic operations;

- if necessary - preparation of a package of documents for deductions from salary shortages;

- reporting for the management office of the enterprise;

- submission of quarterly reports to extrabudgetary funds;

- cash book control;

- timely reflection in accounting of all shortages and surpluses at the cash desk;

- audit of primary cash documentation;

- checking the correctness of the formation of the sales book and preparation of advance reports.

At large enterprises, such positions as a cashier accountant, bank accountant and payroll accountant are separately distinguished.

The duties of the cashier include:

- reception and issue of cash;

- collection of revenue;

- accepting cash from legal entities and individuals;

- issue of money under the report;

- reflection of all operations in the system 1C: Accounting;

- timely completion of the cash book;

- closing of the working day of the cashier-operator.

The bank accountant performs slightly different duties:

- introduction of 51 and 52 accounts;

- work in the “Bank Client” system;

- issuing statements on the movement of funds in the current account;

- filling in payment orders and transferring them to a servicing bank.

The payroll accountant is responsible for:

- timely payroll to company employees;

- calculation of taxes and payments;

- Submission of all necessary reporting to extrabudgetary funds;

- distribution of salary and tax collections on accounts;

- Supervision of registration of salary bank cards;

- accounting for compensation for fuel and lubricants, mobile communications, rental housing and other benefits to employees;

- accounting for the payment of alimony and benefits.

Examples

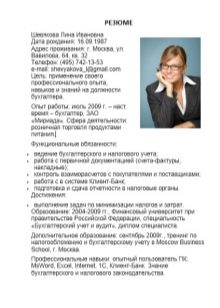

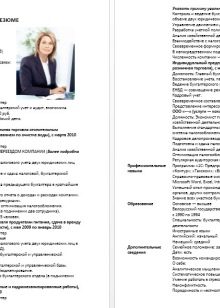

When writing a resume, it is very important to observe the following requirements:

- the text should be written correctly, without syntactic and spelling errors;

- the entire document should be formatted so that the fonts, headings and writing style are consistent;

- only the most important information should be given for the summary - the volume of the document should not exceed 1-2 pages.

We offer you some examples of the correct writing of the resume.

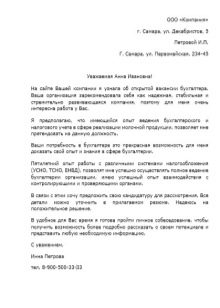

Do not forget to write a cover letter stating the purpose of your appeal and briefly describe your advantages over other candidates.